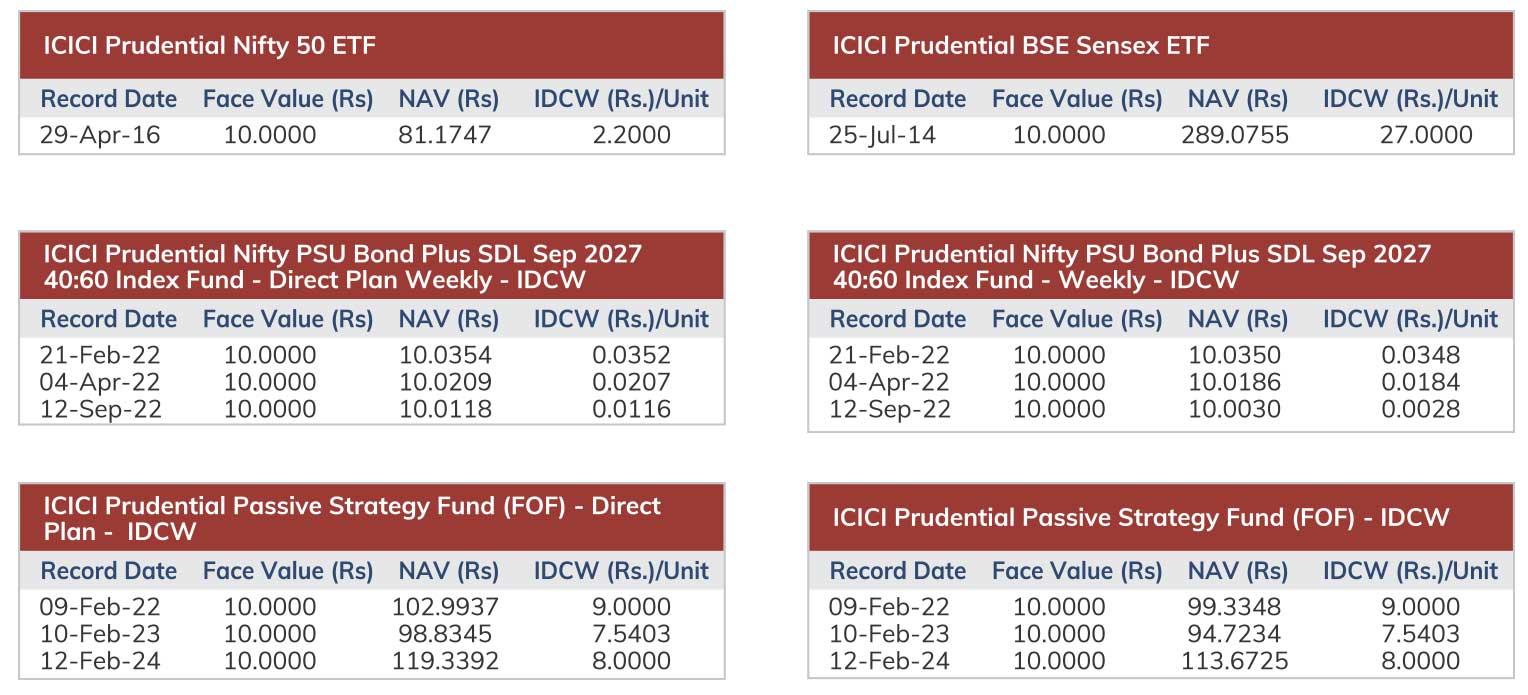

IDCW History

IDCW is gross IDCW. To arrive at the net IDCW payable for corporate and non-corporate investors applicable IDCW distribution tax, if any, needs to be adjusted respectively. Past performance may or may not be sustained in future. After payment of IDCW the NAV has fallen to the extent of payout and distribution taxes if applicable. For complete IDCW history details please refer to our website www.icicipruamc.com, Download section-NAV and IDCW history section.

Distribution of IDCW is subject to availability of distributable surplus and approval of Trustees.

When units are sold, and sale price (NAV) is higher than face value of the unit, a portion of sale price that represents realized gains is credited to an Equalization Reserve Account and which can be used to pay IDCW. IDCW can be distributed out of investors capital (Equalization Reserve), which is part of sale price that represents realized gains.

For information on Record Date for declaration of IDCW under various Schemes of the Fund with IDCW distribution frequency ranging from daily up to monthly distribution investors are requested to visit https://www.icicipruamc.com/docs/default-source/default-documentlibrary/icici_013_dividend-addendum_27-march-2021.pdf?sfvrsn=62de3112_0'